403 B Max Contribution 2025 Catch Up - 403b Max Contribution 2025 With Catch Up Gerry Juditha, The maximum 403(b) contribution for 2025 is $23,000. If you're 50 or older, you can contribute an. Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, If you are under age 50, the annual contribution limit is $23,000. In 2025, employees can contribute up to $23,000 per year to their 403(b) plan, up from $22,500 in 2023.

403b Max Contribution 2025 With Catch Up Gerry Juditha, The maximum 403(b) contribution for 2025 is $23,000. If you're 50 or older, you can contribute an.

403(b) Catchup Contribution Types, Benefits, Risks, & Tips, In 2025, those age 50 and older are able to contribute an added $7,500 to a 403 (b) or 457 (b). This is the total amount that you can contribute to your 403(b) plan from your salary before taxes.

403 B Max Contribution 2025 Catch Up. For help using the calculator,. If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch.

403(b) Contribution Limits for 2025, $23,000 (was $22,500 in 2023). Employees can reach this limit by contributing about.

403b Max Contribution 2025 With Catch Up Gerry Juditha, The annual 403 (b) contribution limit for 2025 has changed from 2023. You need taxable compensation (“earned income”) to contribute to a traditional or roth ira but there’s no age limit.

The annual 403 (b) contribution limit for 2025 has changed from 2023.

The internal revenue service recently announced the annual 403(b) limits for 2025. This contribution limit increases to $23,000 in 2025.

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, The traditional ira or roth ira. You need taxable compensation (“earned income”) to contribute to a traditional or roth ira but there’s no age limit.

Max 401k Contribution With Catch Up 2025 Alia Louise, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025. Your total combined employee and employer match contribution limit.

If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch.

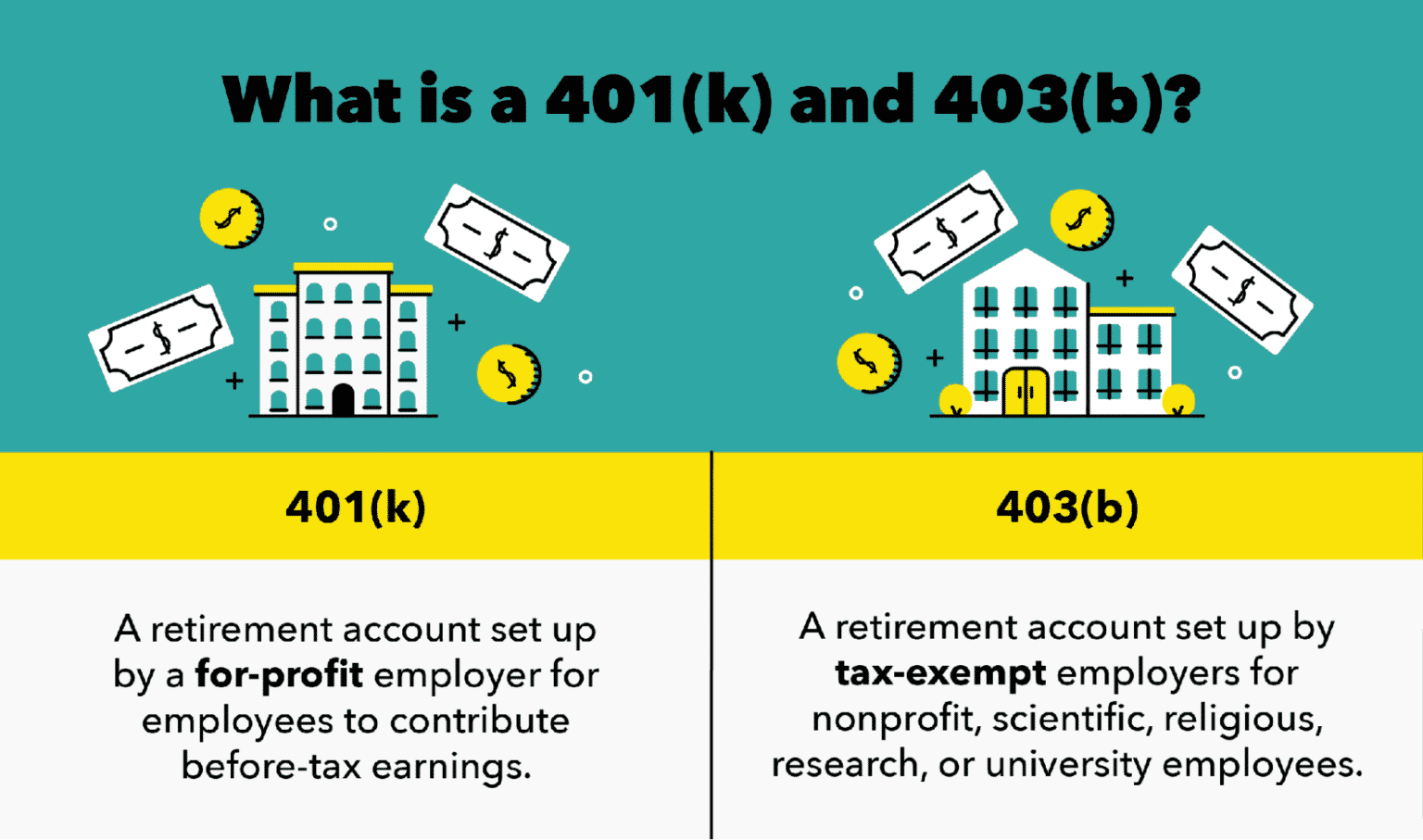

What Is a 403(b) Plan and How Do You Contribute? TheStreet, These allow you to contribute extra to your 403 (b) plan if you're aged 50. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2025.